Ready to put your TAO and Alpha tokens to work? This practical guide walks you through depositing liquidity into Bittensor's Native V3 Pools.

Before You Begin

What You'll Need:

- TAO tokens in your Bittensor wallet

- Basic understanding that you may experience impermanent loss

- Access to a subnet with V3 pools enabled

Important: Not all subnets have V3 pools enabled. Only subnet owners can enable this feature, so you will need to check which subnets allow user liquidity provision.

Step 1: Find Subnets with V3 Pools Enabled

- Navigate to the Subnet Screener Page

- Look for the list of available subnets

- Each subnet will show various metrics and icons

-

Identify V3-Enabled Subnets

- Look for the "Liquid Icon" next to subnet names

- If the Liquid Icon is active/clickable, that subnet has V3 pools enabled

- If the icon is grayed out or missing, V3 pools are not available for that subnet

-

Click on the Liquid Icon

- This will take you to the Liquidity Management page for that specific subnet

- You'll see the deposit interface for that subnet's TAO/Alpha pair

Step 2: Understanding Uniswap V3 Price Ranges

Before depositing, it's crucial to understand how Uniswap V3 works:

Key Concept: Concentrated Liquidity

- Unlike traditional pools where your liquidity is spread across all prices (0 to infinity)

- V3 allows you to concentrate your liquidity within a specific price range

- You set a minimum price and maximum price for your position

- Your liquidity position only earns fees when trading happens within your chosen range

How Price Ranges Work:

- Min Price: The lowest price at which your liquidity will be active

- Max Price: The highest price at which your liquidity will be active

- Current Price: The real-time market price of the Alpha token relative to TAO

Example: If you set Min Price = 0.05 TAO and Max Price = 0.08 TAO:

- Your liquidity earns fees only when the Alpha token trades between 0.05 and 0.08 TAO

- If price moves below 0.05 or above 0.08, your position won't earn fees until price returns to your range

Step 3: Choose Your Price Range Strategy

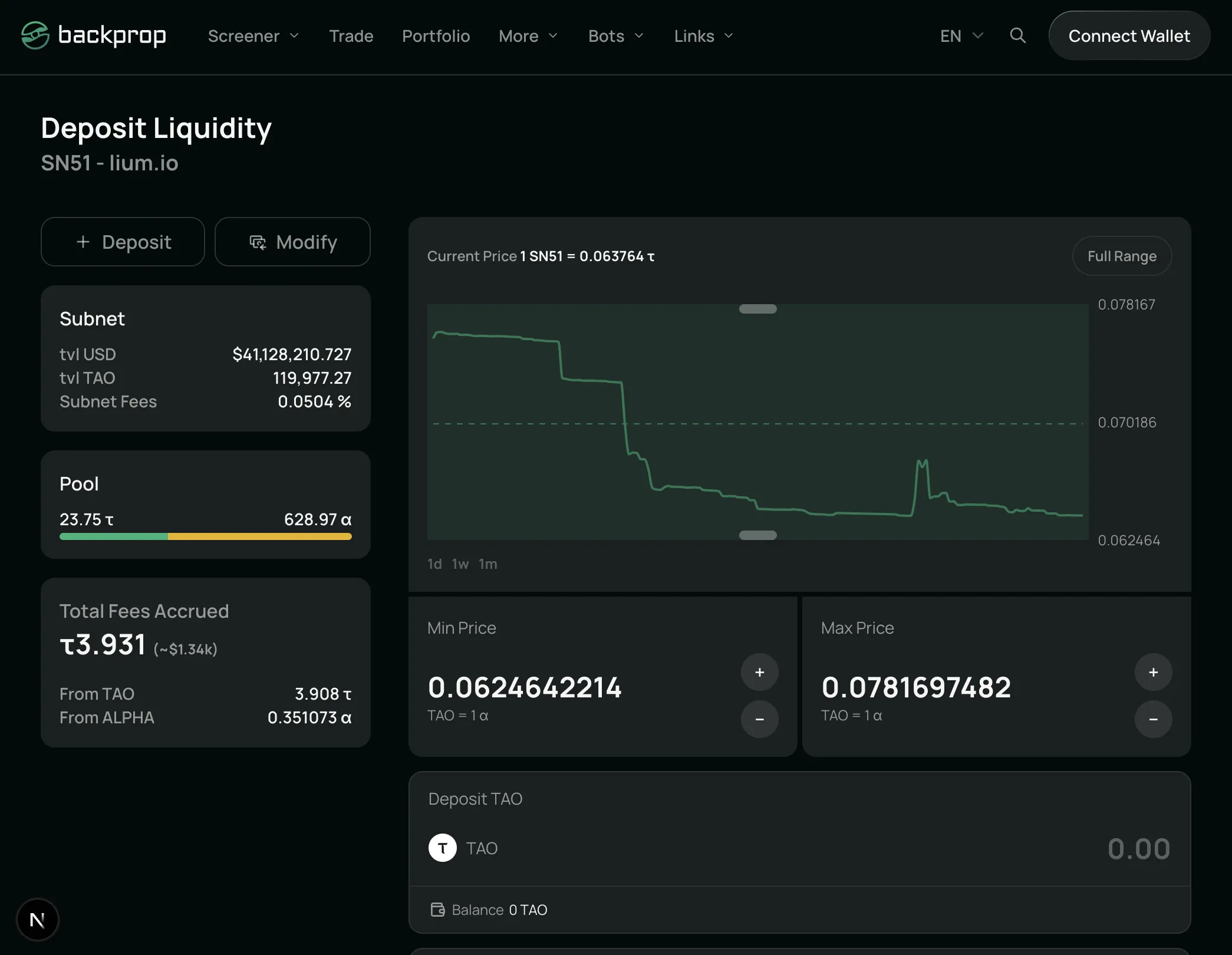

Current Example: SN51 lium.io

- Current price: 1 SN51 = 0.063764 TAO

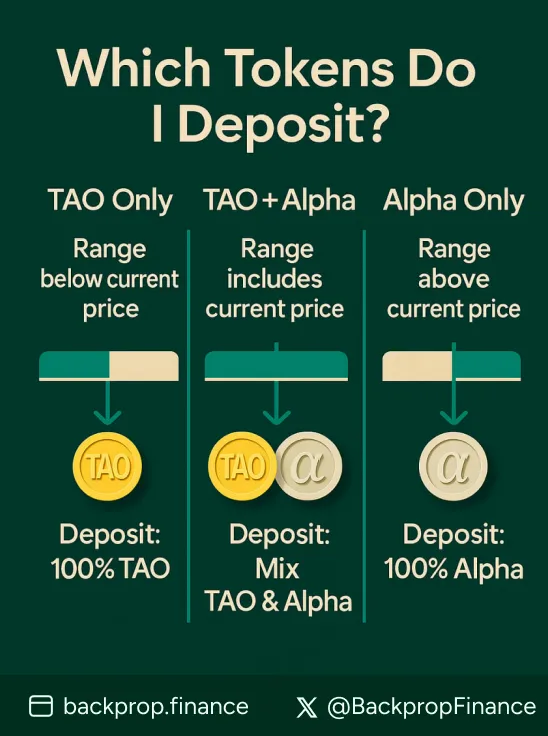

Based on where you set your price range relative to the current price, you'll need different tokens:

Scenario 1: Price Range Below Current Price (TAO Only)

When: Both min price AND max price are less than 0.063764 TAO

Example: Min Price = 0.050 TAO, Max Price = 0.060 TAO

- Deposit: Only TAO tokens needed

- Logic: Since current price (0.063764) is above your range, you start with 100% TAO

- What happens: As price falls into your range, TAO gradually converts to Alpha tokens

Scenario 2: Price Range Crossing Current Price (TAO + Alpha)

When: Min price is less than 0.063764 TAO AND max price is more than 0.063764 TAO

Example: Min Price = 0.050 TAO, Max Price = 0.080 TAO

- Deposit: Both TAO and Alpha tokens needed

- Logic: Current price is within your range, so you need both tokens

- Ratio: Depends on exactly where current price sits within your range

Scenario 3: Price Range Above Current Price (Alpha Only)

When: Both min price AND max price are more than 0.063764 TAO

Example: Min Price = 0.070 TAO, Max Price = 0.090 TAO

- Deposit: Only Alpha tokens needed

- Logic: Since current price (0.063764) is below your range, you start with 100% Alpha

- What happens: As price rises into your range, Alpha gradually converts to TAO

Step 4: Deposit Your Liquidity

-

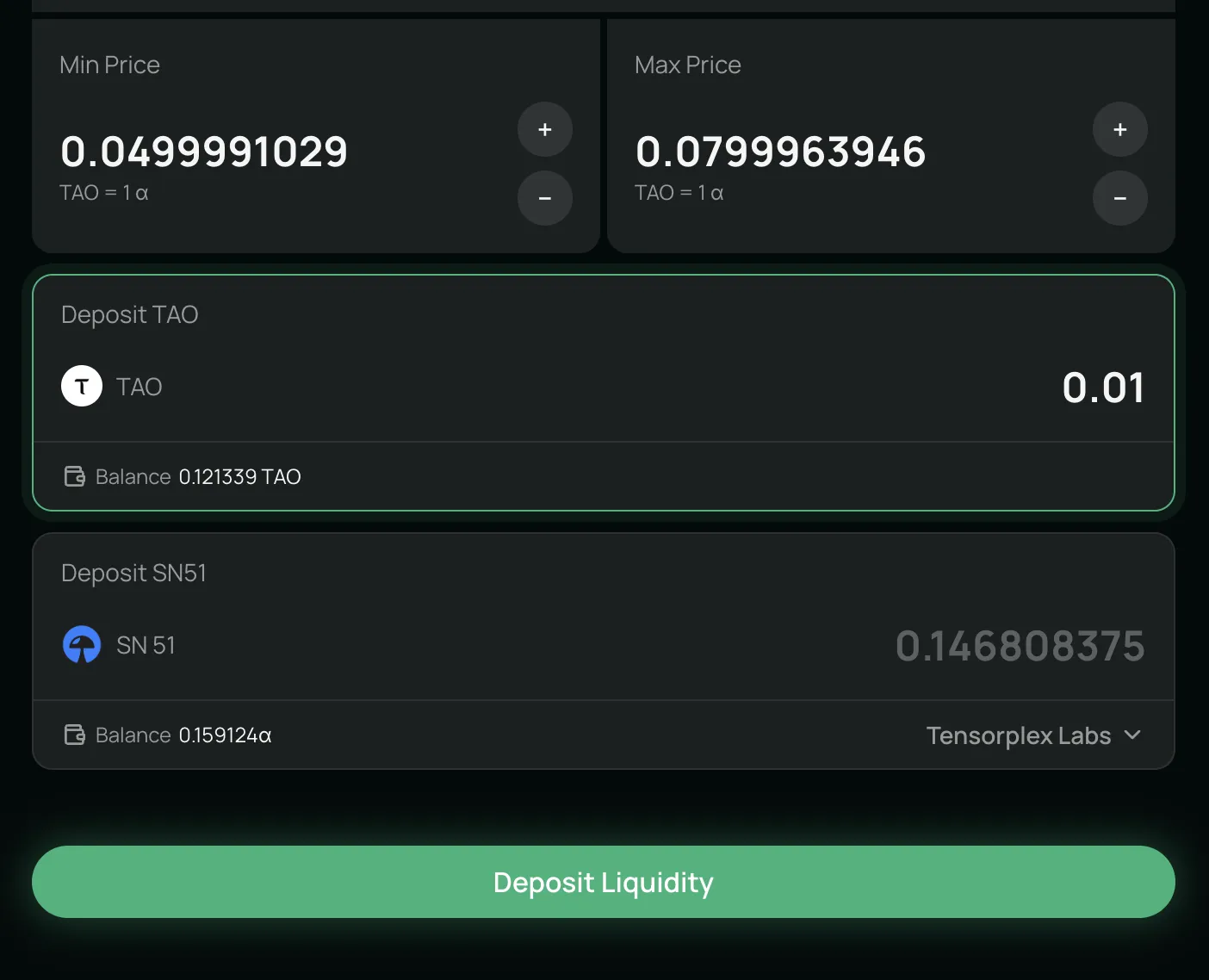

Set Your Price Range

- Use the interface to set your min and max prices

- The interface will show you which tokens you need based on your range

-

Enter Token Amounts

- For TAO-only scenarios: Enter your TAO amount

- For Alpha-only scenarios: Enter your Alpha amount

- For mixed scenarios: Enter amounts for both tokens as shown

-

Review and Confirm

- Double-check your price range

- Verify token amounts

- Click the "Deposit Liquidity" button

-

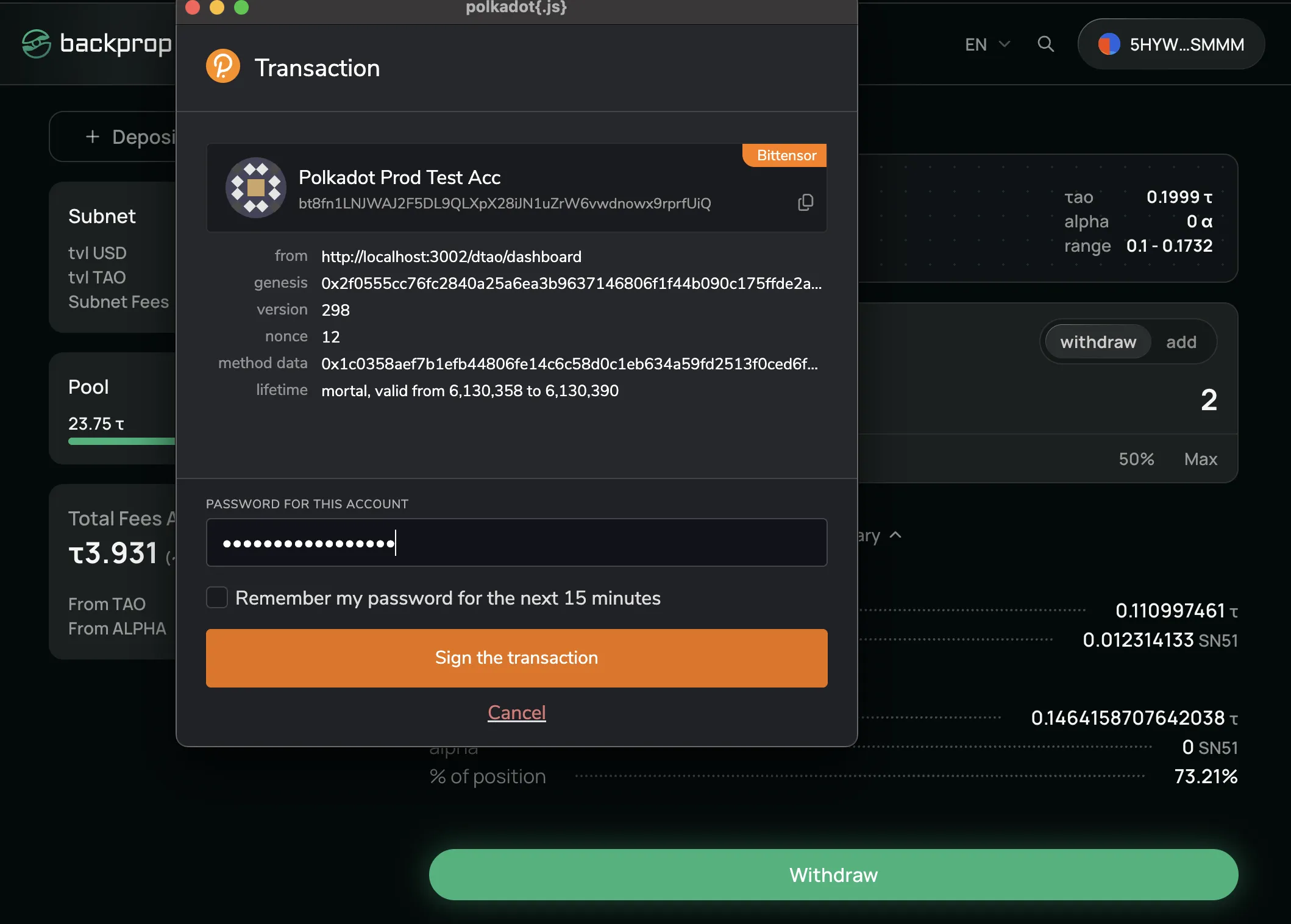

Sign the Transaction

- Enter your wallet password (in this case, Polkadot.js wallet)

- Click "Sign the transaction" to confirm

- Monitor Your Position

- Your position earns fees when trading occurs within your price range

- You can add more liquidity, remove liquidity, or collect fees at any time

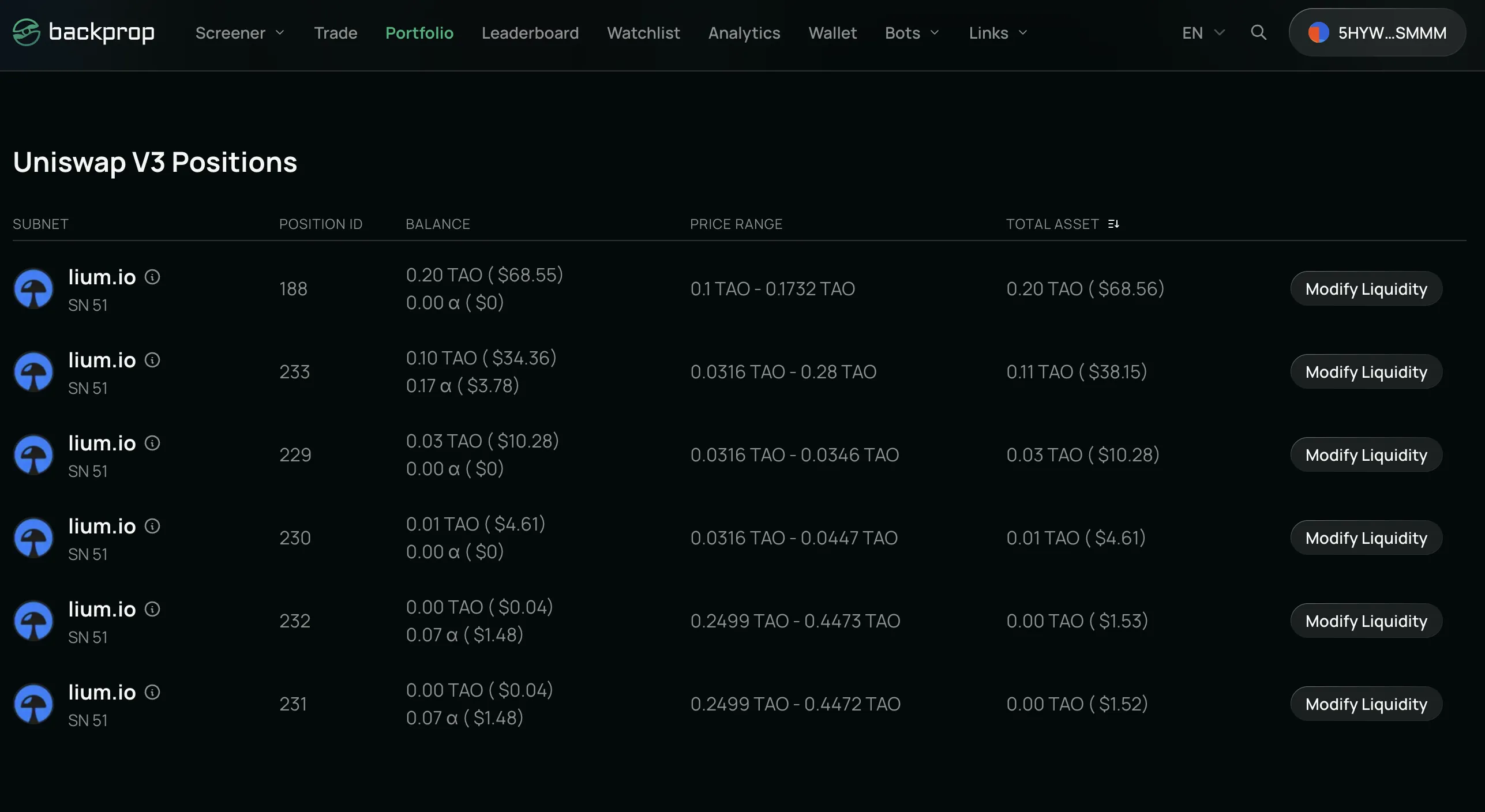

Step 5: View Your Positions

After successfully depositing liquidity, you can view and manage your positions:

- Navigate to Portfolio

- Click on the "Portfolio" tab in the main navigation

- You will see all your current Uniswap V3 positions

- Position Information

- Each position shows:

- Position ID: Unique identifier for your position

- Balance: Current token amounts in your position

- Price Range: Your min and max price settings

- Total Asset Value: Current TAO / USD value of your position

- Each position shows:

Step 6: Modify Your Liquidity

You can modify your existing positions by adding more liquidity or withdrawing some/all of your liquidity:

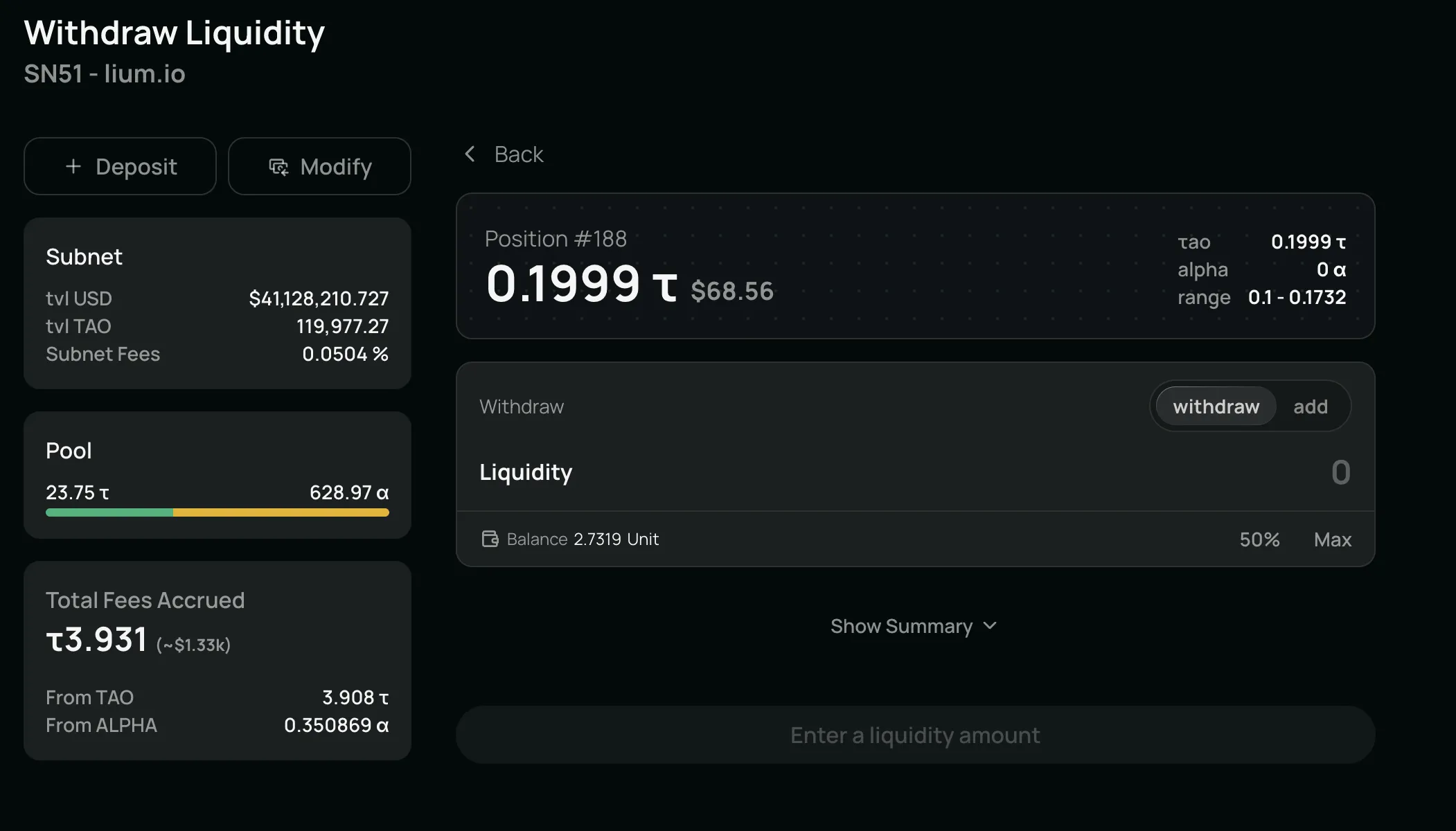

Withdrawing Liquidity

- Access Modify Options

- Click "Modify Liquidity" next to your position

- This will take you to the liquidity management page

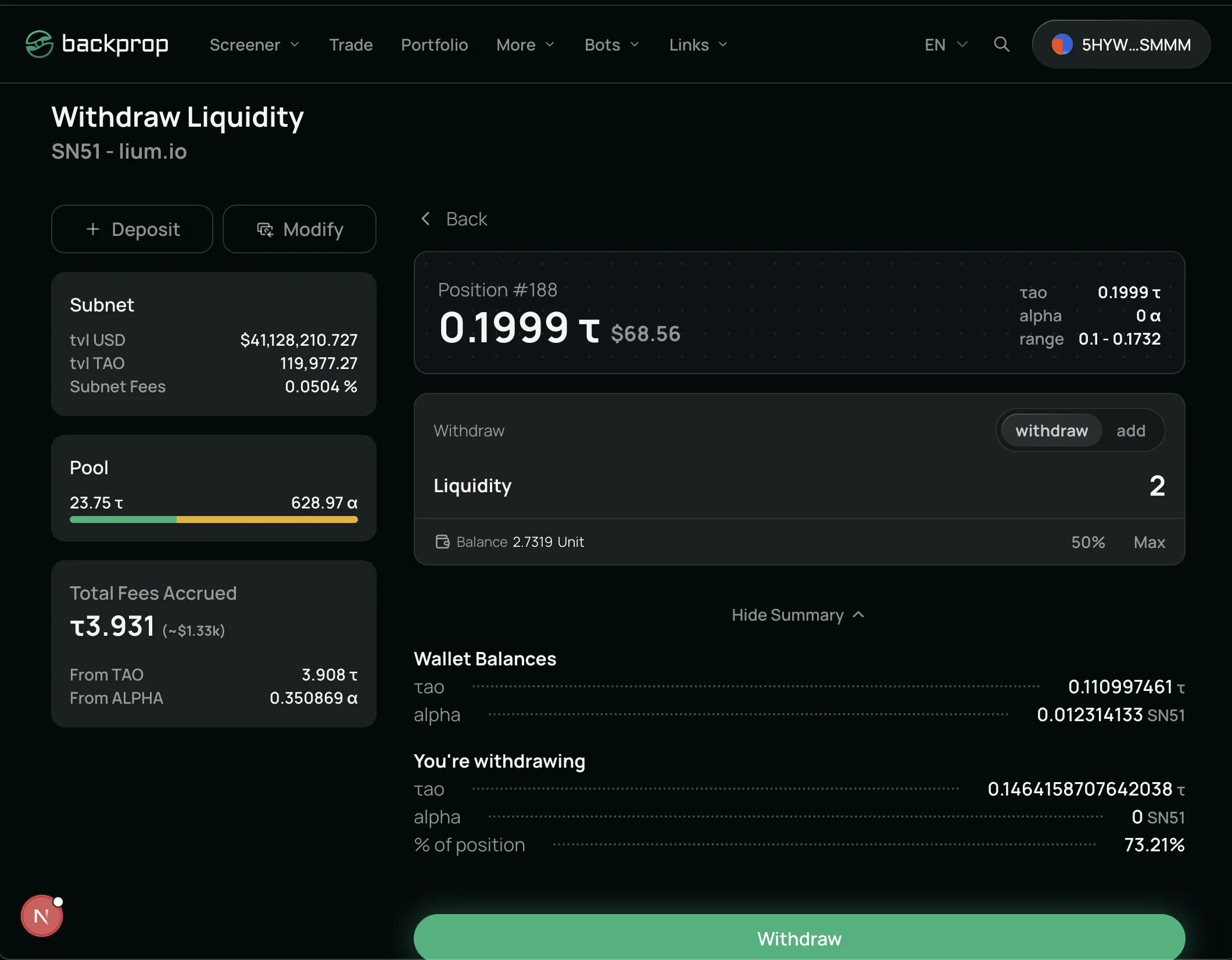

- Choose Withdrawal Amount

- Select how much liquidity you want to withdraw

- You can choose partial withdrawal (e.g., 50%) or full withdrawal (Max)

- Review the preview showing how much TAO and Alpha you'll receive

- Complete Withdrawal

- Click the "Withdraw" button

- Sign the transaction in your wallet

- Your TAO and/or Alpha that you deposited will be returned to your wallet balance + any accumulated fees

Important Note: Due to market fluctuations, the amount of TAO and Alpha you will receive after withdrawal might differ from the initial deposit amount.

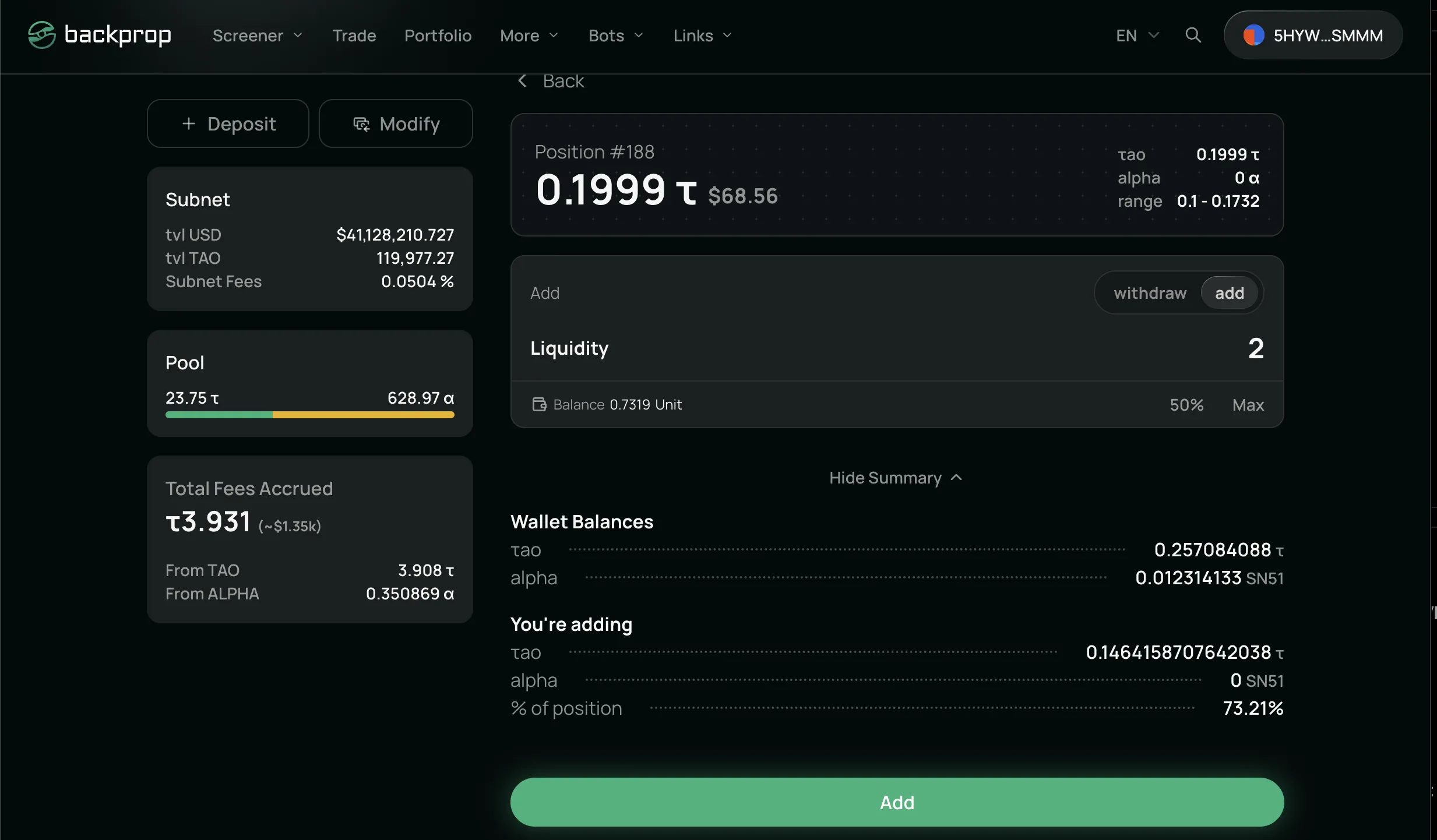

Adding More Liquidity

-

Select Add Option

- Choose to add more liquidity to your existing position

- Enter the amount of additional liquidity you want to add

-

Review Requirements

- The interface will show you how much additional TAO and/or Alpha you need

- Ensure you have sufficient balances in your wallet

- Confirm Addition

- Review the transaction details

- Click "Add" to proceed

- Sign the transaction in your wallet

Key Tips for Success

Choose Your Range Wisely:

- Wider ranges = Lower risk of being out-of-range, but lower fee earnings

- Narrower ranges = Higher fee potential, but higher risk of price moving out-of-range

Risk Management:

- Monitor your position regularly

- Understand that token ratios will change as price moves through your range

- Be prepared for impermanent loss if you exit at unfavorable prices

Active Management Required:

- V3 positions need more attention than traditional liquidity provision such as Uniswap v2

- Consider adjusting ranges if price moves significantly

Remember: V3 liquidity provision is more complex compared to normal Uniswap V2 Pools. Please do due dilligence and research on how Uniswap V3 works.